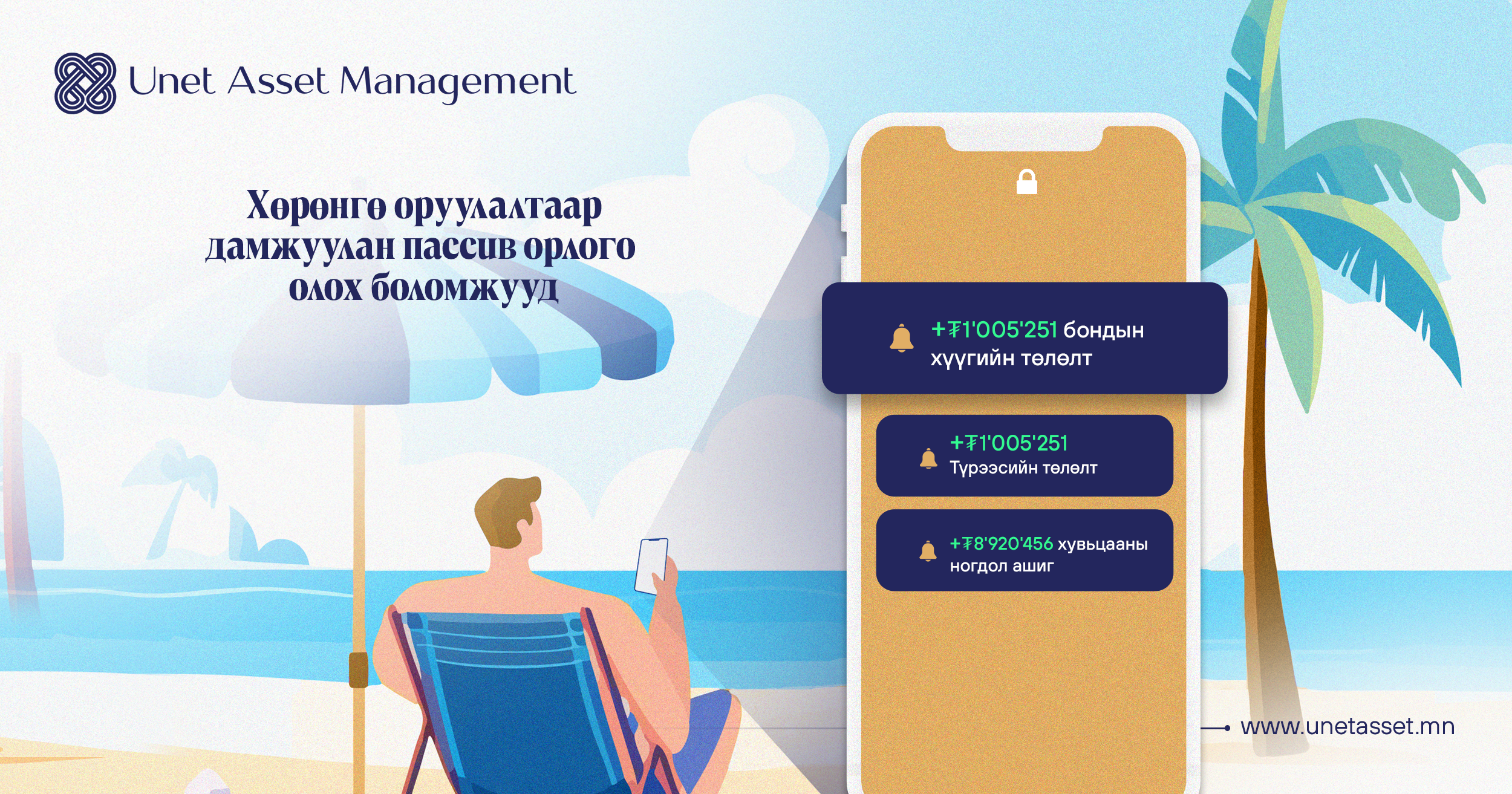

Opportunities to Earn Passive Income Through Investments

Diversifying sources of income and ensuring financial independence is something everyone desires in today’s economic environment. Passive income refers to earning a stable income over the long term without actively working. Passive income is mostly generated through investments and comes in various forms, including rental income, investment returns, and royalties. Passive income helps create financial stability for the future and provides investors with a steady income stream as well as additional gains from the appreciation of their assets.

Here are some examples of passive investment types:

Stocks

By investing in stocks, you become a shareholder in companies and have the right to receive regular dividends. Additionally, you can earn extra income through the appreciation of the stock’s market value.

Bonds

Bonds are like lending money to someone; you receive your principal back along with interest after a certain period.

Real Estate

Investing in real estate such as apartments, buildings, or land can generate regular rental income. This type of investment also has the advantage of hedging against inflation.

Investment Funds

Funds managed by professional financial institutions allow small investors to participate in stock and bond markets. Depending on the fund’s structure, it can provide regular dividend income.

Having passive income offers the following advantages:

Financial Stability:

Passive income generated from investments supplements your main income and ensures financial stability.

Future Security:

Additional passive income beyond your primary earnings helps with retirement and protects against potential future risks.

Time Freedom:

Increasing your passive income allows you to reduce daily work pressure and have more time for other activities.

Creating passive income through investments is one of the most effective ways to achieve your financial goals and ensure future financial stability. However, it is important to plan and execute your investments carefully and based on thorough research. Various instruments like stocks, bonds, real estate, and investment funds offer opportunities to grow your wealth and generate stable income. Nevertheless, before investing, it is always advisable to consider the potential risks and make informed decisions accordingly.