Elon Musk's space startup SpaceX is lining up four Wall Street banks for leading roles on a potential initial public offering that could rank among the largest market debuts ever, according to a per...

Billionaire Michael Saylor's bitcoin-focused firm Strategy said on Tuesday it bought about $2.13 billion worth of bitcoin over the past eight days, stepping up purchases even as its stock has been pre...

BlackRock's (BLK.N), opens new tab fourth-quarter profit surged past Wall Street estimates on Thursday while a rally in markets boosted fee income and lifted the company's assets under management to ...

Following a buoyant year for multi-strategy funds, hedge fund investors aim to allocate more capital towards the biggest money managers in 2026, according to an internal report compiled by Bank of A...

Venture capital firm HSG, formerly Sequoia Capital China, is raising a continuation fund that will take over some of its ByteDance shares at a valuation of between $350 billion and $370 billion, two p...

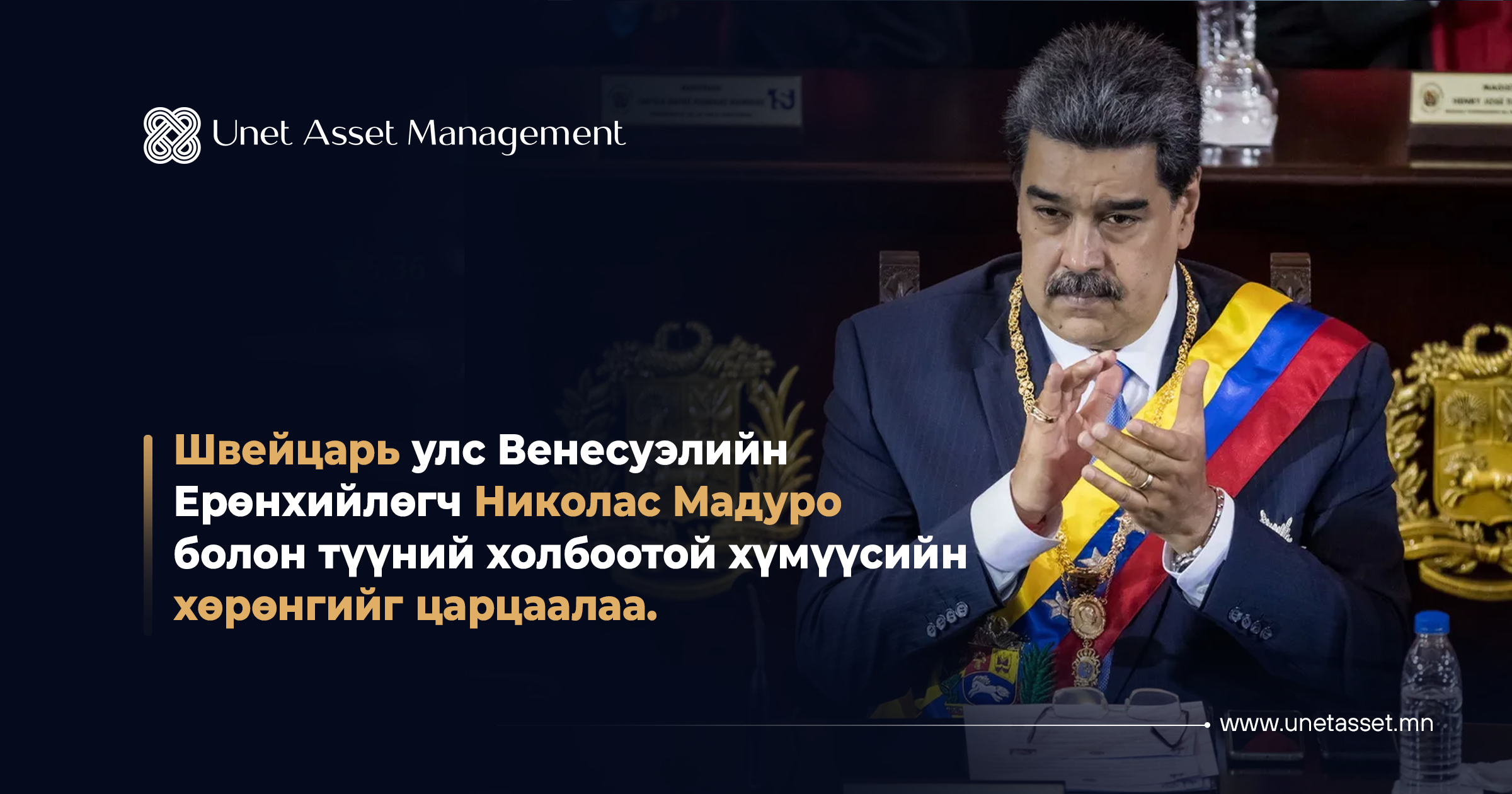

ZURICH, Jan 5 - Switzerland has frozen assets held in the country by Venezuela's Nicolas Maduro and associates, the Swiss government said on Monday, following his arrest by U.S. forces in Caracas and ...

Berkshire Hathaway (BRKa.N), opens new tab shares closed slightly lower on Warren Buffett's final day as chief executive, with the legendary investor set to hand the reins to Greg Abel on Thursday. T...

Japan's Mizuho Securities on Wednesday said it will buy a majority stake in Indian investment bank Avendus from U.S. investment firm KKR for up to 81 billion yen ($523 million). The buyout adds to Ja...

Japan's SoftBank Group (9984.T), opens new tab and Nvidia (NVDA.O), opens new tab are in talks to invest in Skild AI, in a more than $1 billion funding round that could value the maker of foundation ...

Global hedge funds, including stock pickers, have generated returns of nearly 15% in 2025 to the end of November, according to a Goldman Sachs report, edging out several large multi-strategy hedge fun...

A group of banks is in talks to lend another $38 billion for Oracle (ORCL.N), opens new tab and data centre builder Vantage to fund further sites for OpenAI, the Financial Times reported on Friday, c...

China's nascent private REIT market has emerged as a rare bright spot for cash-strapped developers, with a record fundraising pipeline of $12 billion for this year, driven by rising investor demand fo...

The AI boom is bringing new risks to the financial markets as investors flock to tech stocks and executives pay steep premiums to buy AI technology they cannot build in-house, warned two top finance ...

Nokia unveiled a new strategy on Wednesday focused on artificial intelligence, as it strives to simplify its business and boost annual core profit by as much as 60% over the next three years. Begin...

Saudi Arabia will sign energy sector agreements with the U.S. worth $30 billion, the CEO of Saudi state oil giant Aramco, Amin Nasser, said on Wednesday in comments carried by Saudi state TV. His com...

Counter-drone radar manufacturer Chaos Industries raised $510 million in a funding round that closed last month, the company's CEO said, the latest sign of booming investor interest in emerging milita...

Global private equity partners are eyeing a return to China after staying on the sidelines over the last few years, encouraged by cheaper valuations and as investors pare U.S. allocations, top fund e...

Global hedge funds' exposure to crypto markets is increasing, and more than half are now invested in the sector, with the U.S. government's embrace of digital assets boosting interest, according to an...

EnduroSat said on Thursday it has raised $104 million from investors, Google Ventures and the European Investment Council Fund, as the Bulgaria-based company scales up production of its small and mid...

Sorry, this entry is only available in Mongolia....

Global hedge fund capital rose to a record of almost $5 trillion in the third quarter and the number of hedge funds is at a decade peak, reflecting an influx of new money into the sector, a report by ...

Sorry, this entry is only available in Mongolia....

Reflection AI, a startup backed by Nvidia, said on Thursday it has raised $2 billion in a new funding round that values the company at $8 billion, as investor interest in artificial intelligence remai...

Bridgewater's Pure Alpha fund surges 26% on year-to-date basis Marshall Wace's Eureka Fund sees 8.04% year-to-date return Systematic stock trading funds up more than 13% in 2025, Goldman Sachs...

Artificial intelligence startups are attracting record sums of venture capital, but some of the world's largest investors warned that early-stage valuations are starting to look frothy, senior investm...

Hedge funds bought banks, insurance and consumer finance companies last week at the fastest pace in three months, Goldman Sachs said in a research note, amid increased dealmaking expected to boost pro...

OpenAI, Oracle (ORCL.N), opens new tab and SoftBank (9984.T), opens new tab on Tuesday announced plans for five new artificial intelligence data centers in the United States to build out their ambitio...

SoftBank Group (9984.T), opens new tab will lay off nearly 20% of its Vision Fund team globally as it shifts resources to founder Masayoshi Son’s large-scale artificial intelligence bets in the United...

The CEOs of the ChatGPT maker OpenAI and Nvidia (NVDA.O), opens new tab plan to pledge support for billions of dollars in UK data center investments when they head to the country next week at the same...

Stablecoin issuer Figure Technology, along with some of its existing investors, raised $787.5 million in a U.S. initial public offering on Wednesday, becoming the latest crypto firm to tap public mark...

Carlyle Group (CG.O), opens new tab said on Thursday it had raised $20 billion to buy second-hand private equity stakes from investors looking to offload assets that built up during a downturn in publ...

NEW YORK, Sept 5 (Reuters) - After a surprisingly weak U.S. payrolls report that underscored that the economy is slowing, investors see the need for accelerated monetary easing, including an increased...

Italy’s UniCredit (CRDI.MI), opens new tab said on Thursday it has increased its stake in Greece’s Alpha Bank (ACBr.AT), opens new tab to nearly 26% after entering into financial instruments for an ad...

Norway's $2 trillion wealth fund, the world's largest, said on Monday it has divested from U.S. construction equipment group Caterpillar (CAT.N), opens new tab and from five Israeli banking groups on ...

The BlackRock Investment Institute believes investors should bulk up their exposure to hedge funds. The research arm of the asset manager suggests investors dedicate up to 5% more of their portfolios ...

Warren Buffett's Berkshire Hathaway (BRKa.N), opens new tab disclosed on Thursday a new investment in UnitedHealth Group (UNH.N), opens new tab after the insurer became a target for many Americans ups...

Hedge fund returns climbed in July as many were lifted by rising stock markets that hit record highs, though others were caught in turbulence sparked by U.S. trade uncertainty, according to a Goldman ...

Foreign investors flocked to Asian stocks for the third straight month in July, with inflows into Taiwan hitting a near two-decade high and Thailand snapping its nine-month losing streak, buoyed by gr...

Singapore's central bank will place S$1.1 billion ($856.36 million) with three asset managers as part of a S$5 billion programme to boost the stock market, it said on Monday, with more co-investments ...

Hedge funds focused on Chinese equities posted double-digit returns in the first half of the year, outperforming global peers, fuelled by a rebound in Hong Kong stocks and bets on artificial intellige...

Hedge funds say they are prepared if U.S. President Donald Trump fires Federal Reserve Chair Jerome Powell before his term expires next year. The dollar briefly tumbled on Wednesday and long-dated Tre...

Global hedge funds had their strongest inflows in the first half of the year since 2015, gaining popularity in turbulent markets amid U.S. President Donald Trump's new trade policies, data from provid...

Russia has launched a new type of investment account that contains withdrawal guarantees, according to a decree signed by President Vladimir Putin on Tuesday, as Moscow looks to attract foreign invest...

Swedish pension fund AP7 said on Friday it has blacklisted and sold all its shares in U.S. electric vehicle maker Tesla (TSLA.O), opens new tab, citing violations of union rights in the United States...

Swedish pension fund AP7 said on Friday it has blacklisted and sold all its shares in U.S. electric vehicle maker Tesla (TSLA.O) citing violations of union rights in the United States. "AP7 has dec...

Hedge funds bought global equities last week at the quickest pace since November 2024, Goldman Sachs said in a note, just as stock markets ended the month with their most positive May performance in d...

Grammarly has raised $1 billion in non-dilutive financing from General Catalyst to expand its artificial intelligence (AI) offerings, aiming to grow into a comprehensive productivity platform, the com...

Billionaire investor Bill Ackman’s hedge fund, Pershing Square Capital Management, has reshaped its portfolio with a significant investment in Amazon. They decided on this move because they believe Pr...

Berkshire Hathaway, led by Warren Buffett, announced in its May 15, 2025 report that it has doubled its holdings in the alcoholic beverage producer Constellation Brands by acquiring 12 million shares,...

Major reforms aimed at prioritizing long-term value and supporting sustainable investments have begun in China’s investment fund sector. The China Securities Regulatory Commission (CSRC) has decided t...

U.S. President Donald Trump’s tariff policy has created economic instability, leading investors to increasingly move away from traditional investments and into cryptocurrencies. Although Bitcoin star...

News Summary The U.S. Federal Reserve has kept the policy interest rate steady within the range of 4.25% to 4.50%. Amid ongoing policy changes under Trump’s administration, the future ...

Investors are pouring large amounts of capital into European equity funds, while pulling money out of U.S. funds for the third consecutive week. May 2, 2025 (Reuters): In the week ending April 30, Eu...

Japan’s ruling Liberal Democratic Party (LDP) have called on the country’s largest pension fund, the Government Pension Investment Fund (GPIF), to increase its investments in domestic private equity a...

According to The Times, BlackRock’s CEO is investing in undervalued assets in the United Kingdom. On April 24, 2025, Reuters reported that BlackRock, the world’s largest asset management company, is ...

Gold is an investment asset that tends to increase in value during times of international instability and inflation risks. Experts worldwide believe that factors such as U.S. foreign trade polici...

The hedge fund “Greenlight Capital” earned an 8.2% profit in the first quarter of 2025, outperforming the market average. The primary reason for this success was their investment in gold. In a letter ...

As of the first quarter of 2025, due to the unstable trade policies in the US, especially technology company stocks experienced significant declines. As a result, investors shifted their assets to mo...

On April 11, 2025, reports from Shanghai indicated that, amid escalating trade tensions with the United States, Chinese stock exchanges have imposed restrictions on daily stock sales by hedge funds an...

The fund is expected to close fundraising in June 2025 and is projected to reach at least 100 billion yen based on current investor commitments. Investments will primarily focus on office spaces, mult...

Global Stock Markets Plunge After U.S. Tariff Announcements by President Donald Trump The global equity markets saw a sharp decline following the U.S. administration under President Donald Trump anno...

The average annual return of the S&P 500 index is approximately 7.55%, of which 93.7% is generated by the growth of the top 20 companies such as Apple, Microsoft, and Amazon. The remaining 480+ co...

On March 14, 2025, Reuters reported that Asia-focused hedge funds have outperformed their U.S. counterparts during the recent market downturn. Driven by a global influx of investors into the Chinese m...

Specifically, Japanese investors made a net purchase of 3.45 trillion yen (approximately 23.44 billion USD) in foreign bonds, marking the highest level since August 2024. Meanwhile, they sold foreign ...

According to Goldman Sachs, hedge funds have been rapidly exiting U.S. technology and media sector stocks over the past six months. Between February 14-20, the movement of hedge funds exiting technol...

According to the Goldman Sachs report, hedge funds have raised their investments in Asian equities to the highest level in recent years, marking the largest increase since 2016. Increase in investmen...

Major international hedge funds and investors are purchasing shares in China’s real estate sector, anticipating that the prolonged crisis in this industry is nearing its end and a recovery is underway...

Expanding Sales Opportunities Using AI In the investment management sector, adopting artificial intelligence (AI) to improve operational efficiency has become widespread. However, in 2025, there is e...

he Rule of 72 is a simple way to estimate how long it will take for an investment to double in value, given a fixed annual rate of return. How it works: You divide the number 72 by the annua...

Swap Agreement One of the most important derivative financial instruments in the modern financial market is the swap agreement. It is a contract between parties who agree to exchange cash flows or as...

What is an option contract? An option contract is a widely used derivative financial instrument in the financial market. It grants the buyer the right—but not the obligation—to buy or sell a specific...

In recent years, investors worldwide have begun to prioritize not only financial returns but also the impact of their investments on the environment, society, and governance (ESG – Environmental, Soci...

Opportunities to Earn Passive Income Through Investments Diversifying sources of income and ensuring financial independence is something everyone desires in today’s economic environment. Passive inco...

What is a Forward Contract? A forward contract is a widely used derivative financial instrument in financial and commercial markets. It is an agreement between two parties to trade a specific asset o...

What Is Building an Investment Portfolio? Building an investment portfolio is a strategy of diversifying investments to reduce risk and increase returns in the financial market. It plays a crucial ro...

Derivatives are financial instruments or investment tools whose value is based on the price or value of an underlying asset in the future. These instruments are mainly used to reduce market risk cause...

What Is a Market Index? Understanding the S&P 500 and Its Role in Investing If you’ve ever followed the news about the stock market, you’ve probably heard about indexes like the S&P 500, Dow ...

A share represents the right to own a certain part of a company, meaning that by investing in the company, the shareholder has the right to participate in the shareholders' meetings and vote, receive ...

As of 2025, the average annual interest rate on savings in Mongolia is 12%, while the national inflation rate stands at 8.1%. Simply put, your real annual return on savings is only 3.9%. For example, ...

A bond is a type of investment instrument issued by the government, state-owned enterprises, or private companies on the capital market. The bond issuer borrows a certain amount of money (face value) ...

Does Your Business Need Investment? “Unet Asset Management LLC” operates under the slogan “Creating Value” and strives to invest in innovative, high-quality, value-creating projects and companies tha...

An investment instrument refers to the financial and tangible assets that individuals and organizations use to grow, protect, or earn additional profit from their money. These instruments come in vari...

We face risks of varying degrees in our daily lives. Since risk brings different consequences depending on the situation, it is most effective to apply appropriate measures tailored to each type of ri...

What is Asset Management Service and Why is it Important? Asset management service helps create an optimal investment plan tailored to your financial goals, allowing your money to grow more efficient...

Types of Investment Funds in Mongolia According to the laws currently in force in Mongolia, investment funds are classified into two main types based on the type of investor and operational character...

An investment fund is a financial instrument that collects capital from the public and invests it in securities based on professional research and investment decisions, with the goal of growing the va...

Asset management services are suitable for anyone who aims to continuously grow their wealth while protecting it from the dangers of inflation. It’s time to let go of the outdated belief that complex ...

Do you want to choose when, where, and what to invest in by yourself? Or do you think it's better to let a professional team handle everything for you? Broker or Asset Manager? Which one is more suit...